AND grows September 2020 YTD topline by 33% and reduces net loss by 23% YOY, in difficult Covid-19 impacted economic environment.

Covid-19 and the related measures taken both in the spring and during September and October to prevent the spread of the virus have proven to be a significant challenge for the global economy. The AND team and our underlying business have however shown very strong resilience: revenue has increased by 33% during the first 9 months of 2020 compared to the same period last year . This is mainly due to our success in winning and delivering new service projects, and moderately growing our existing recurring business. The direct impact of the lockdown was mostly felt within the data sales segment, where it was and to some extend still is difficult to connect with key decision makers and win new customers.

OPERATIONAL HIGHLIGHTS AND STRATEGY UPDATE

In the third quarter 2020, we focused on improving our processes, developed new products, continued to deliver outstanding service quality and extended our sales team in the Netherlands, Germany and the USA.

Thanks to improved internal processes, we pulled the mid-year reporting forward by one month and improved our visibility for the full year. These improvements enabled us to give guidance on revenue, profit & loss and enabled us to provide quarterly updates to our stakeholders.

During the summer months, our research and development team has focused on developing new products to enhance our portfolio within premium location-aware content and expand our service offering in more location content APIs.

On September 2nd, we launched our Eco Alert Zones. This is a whole new category of products for AND. We offer highly curated and dynamic data on worldwide congestion and low emission zones for passenger cars. This daily updated dataset is offered as a annual subscription and will contribute to our goal of increasing recurring revenue. The product was already been embraced by a large global tech company which has access to a large customer base of of mobile users.

On September 16th, we launched our new turnkey solution for outdoor venue owners Ii.e our Outdoor Venue Plan. This service makes use of our 25 years of experience in creating digital maps and location enabled smart web services such as the MapTiler. Some of our partners are already using this service and helping us to finetune its functionality further for campsites, holiday parks or industrial areas across the world.

In Q3, demand for our data research and aggregation services showed a strong increase. Therefore we needed to add resources to the team in the Netherlands. In close cooperation with our production partner in India, we delivered world class and uniquely qualified content on congestion Zones, ferry lines and trails in Europe. These projects will continue to generate revenue in Q4.

In Q3, we also attracted new experienced talent to our Sales team in the Netherlands. This extension enabled us to deepen our market knowledge and and increase our speed to market which resulted in a stronger pipeline as demonstrated by . the addition of new customers with multi-year subscription contracts for our map tiler service.

On October 15th, we launched the rebranding of AND to GeoJunxion. This new brand underlines our new strategic direction and will help us to further articulate our new product development as well as support our e-commerce platform for developers.

As our growth is mainly driven by B2B business development, the restrictions in visiting prospects and customers, hamper our ability to win new customers and increase market share.

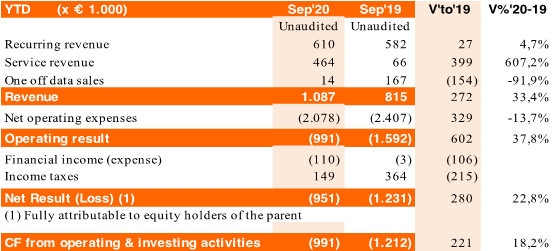

FINANCIAL SUMMARY SEPTEMBER 2020 YEAR TO DATE RESULTS

- Revenue September 2020 YTD is up by 33% to €1.087 K;

- Operating result improved by 38% to a loss of €991 K, compared to a loss of €1.592 K in Sep’19 YTD;

- Net result after tax improved by 23% to a net-loss of €951 K versus €1.212 K in Sep’19 YTD;

- Net cash-flow from operating and investing activities equals an outflow of €991 K Euro, an improvement of €221 K versus the same period last year;

- Consolidated cash-position equals €682 K (Sep 30, 2019: €982 K).

KEY FIGURES

OUTLOOK FOR THE FULL YEAR 2020

The increasing number of Covid-19 infections in many countries in Europe is again causing uncertainty resulting in an economic slowdown . The partial lockdown in many of our target markets such as the Netherlands, Germany and the USA is unfavorably impacting our high end outlook. In spite of this adverse impact, AND is pleased to confirm the lower end of the revenue guidance provided in August. For the full year 2020, we expect to generate a revenue within the range of €1,550 K to €1,700 K, which represents a YOY growth in the range of 46% to 60% compared to 2019 . This is expected to result in an operating loss in the range of €1,450 K to €1,300 K, a net loss in the range of €1,200 K to €1,100 K and a cash outflow in the range of €1,400K to €1,300 K. The high end of the revenue range has reduced as a result of slower decision making processes particularly within our data sales prospects. Our revenue mix shows an increase in the service revenue, which requires additional resources to meet this demand. Service projects also have a longer cycle to convert into cash, which explains the higher cash outflow guidance.

FINANCIAL POSITION

AND is making significant progress in turning its business around from an automotive map supplier focused on one off large deals to a location-aware content service provider. This transition requires investment in product development and sales and marketing. The convertible loan closed in February 2020 has provided the required funding to develop an interesting set of new products. Additional funding is required to enable AND to grow with its new business model into a cash generating and profitable organization. AND expects to complete the funding in Q4 2020.

REPLACEMENT OF EXTERNAL AUDITOR

We continue to explore the options to replace our previous OOB-licensed auditor, Grant Thornton. However, to date no available alternative auditor has yet been identified. To allow more time in resolving this issue, AND has decided to call an Extraordinary General Shareholders Meeting in December. Part of the agenda will be a request to shareholders to approve the extension of the accounting year until 30 June 2021. For the full agenda, please refer to a separate press release. issued on 29 October 2020

RISK MANAGEMENT

Risk management is an integral managerial task. Our risk management and control procedures take into consideration the size of the company and the character of the business in order to identify the most significant risks which the company is exposed to. The risks identified are discussed on a periodical basis and mitigated where possible. Such a system cannot provide absolute certainty that objectives will be realized. Neither can it guarantee prevention of potential cases of material mistakes, damage, fraud or breaches of statutory laws.

The 2019 annual report describes the principal strategic, operational and financial risks. The risks and uncertainties described in the annual report are still relevant and are deemed incorporated and repeated by reference in this report. There were no cases of material damage, fraud or breaches of law detected in the first half year. However, the Covid-19 outbreak and the associated pandemic controls have had a disruptive effect on the economy and an adverse effect on our business. Most noticeably in our data sales business and associated revenues. In spite of the fact that we have taken mitigating actions and we can see signs of economic recovery, there is no guarantee that the pandemic and its associated control measures will not have a further negative impact on our business, financial position and results.

BOARD OF MANAGEMENT STATEMENT

The Board of Management hereby declares that, to the best of its knowledge, the summarized consolidated September 2020 YTD financial statements, drawn up in accordance with IAS 34 “Interim financial reporting”, represents a faithful rendering of the assets, liabilities, financial position, profit and cash flow of AND International Publishers NV and its subsidiaries as stated in the consolidated financial report, and that the Board report as included in this September 2020 YTD report represents a faithful rendering of the information required in relation to item 5:25d subs 8 and 9 of the Dutch Financial Supervision Act.

GROUP STRUCTURE SIMPLIFICATION

During Q3 2020 the dissolution of AND International Publishers PLC (UK) and AND North America LLC (USA) was completed. The voluntary liquidation of AND Data India Pvt, LTD, has made significant progress: the legal steps to appoint a liquidator have been completed; the GST (Indian VAT) receivable has been refunded; the liquidator is progressing through the step plan. As a result of ongoing Covid-19 related lockdowns and unavailability of Indian government institutions, it remains difficult to predict the exact completion date. We expect the repatriation of a significant portion of the funds during Q4 2020 and the completion of the voluntary liquidation in subsequent months.